The FAFSA®: What it Does & Doesn’t Do

Good FAFSA planning can shave a few thousand dollars off your annual cost to attend if your student is eligible for need-based aid.

Understanding the FAFSA® & CSS Profile™️

I think the biggest misperception about the FAFSA is that it’s the tooth fairy. It’s not. It’s a tool that colleges use to evaluate all students’ ability to pay on a consistent set of metrics by calculating a number called the Expected Family Contribution or EFC.

If you only know two things about the FAFSA, they should be this:

First, The FAFSA tells you what the federal government thinks you should be able to spend for college annually, but it does not require schools to meet your need.

Second, whether or not you think you will get financial aid, you should still fill out the FAFSA.

The FAFSA will not tell you how much college will cost or how much you can afford. What you can afford is a function of your budget, which you’ve already worked on. What a specific college costs is a function of how that college prices its services and uses different forms of aid to attract desirable students.

Here’s the thing about the FAFSA: pretty much every school offers some form of need-based aid, and many of them offer grants to students with demonstrated need– which is the difference between the EFC/SAI and the cost of attendance. Good FAFSA planning can shave a few thousand dollars off your annual cost to attend if your student is eligible for need-based aid.

Every college uses the FAFSA because it’s required for all federal student aid programs including direct student loans and parent PLUS loans.

The FAFSA guarantees access to federal student aid programs and some state programs. It does not guarantee need-based financial aid at the school of your choice.

And then in addition to the FAFSA, there’s another aid form called the CSS Profile that’s used by some private schools.

What does the FAFSA do?

Tool that allows colleges to evaluate all students’ ability to pay on a consistent set of metrics

All schools use it; few meet all need through grants

FAFSA guarantees access to federal student aid programs and some state programs

The FAFSA does not guarantee need-based financial aid at the school of your choice

Schools using the CSS Profile—about 240 private schools (of the 1700)— also require the FAFSA

What the FAFSA guarantees is access to federal student aid programs. Those are:

Need-Based

Pell Grant

Perkins Loan, Subsidized Direct Student Loan

FSEOG Grant

TEACH Grant

Work-Study

Non-Need-Based

Direct Student Loan (Unsubsidized)

PLUS Loan (parents, grad school)

And again, many schools offer financial aid to students whose EFC as calculated by the FAFSA shows that they are not able to meet the full cost of attendance. Having an EFC that is lower than the cost of attendance is called demonstrated need.

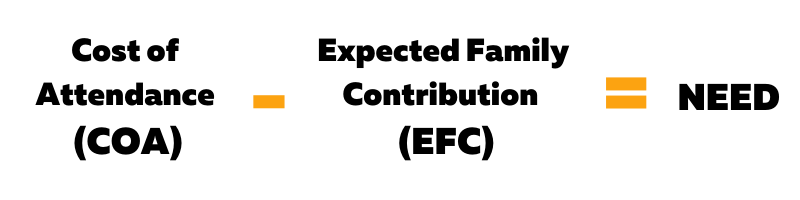

Financial need is very specific. The cost of attendance at the school minus your EFC is your financial need.

Do you have need?

Financial need is very specific. The cost of attendance at the school minus your EFC is your financial need.

Everyone should file the FAFSA

Many families think there’s no point in doing the FAFSA because they assume they don’t have financial need. That reflects a fairly limited view of the FAFSA; in fact, there are plenty of good reasons why every family of a student who’s even potentially college-bound next year, regardless of the family’s financial position, should do it.

Your family’s financial situation could change. A job loss or medical issue could suddenly make college considerably less affordable, for example. Think of the FAFSA as an insurance policy in case something goes wrong: you’ll need to have completed it to request assistance from your school if things change.

College may cost more than you expect. After factoring in housing, meal plans, travel, health insurance, activities and so on, many families find that college costs a few thousand dollars more each year than they had planned for.

You may be eligible for more aid than you think. This is especially true for families who are sending their second student to college. Even if no financial aid was granted to the first student, with two in college this could change since your EFC is divided between your two students.

The FAFSA may be required for merit award consideration. Many merit scholarships have a need component and thus require applicants to submit the FAFSA to be considered.

It’s the only way to access to federal student loans. Families who even think they might borrow will want to start with the federal direct student loan since it has the best interest rates and protections. The FAFSA is required for these loans.

A strong financial position can be a plus for admissions. As much as students and families talk about scholarships, colleges and universities talk about finding students who don’t need financial aid. If you’re in a strong financial position and applying to reach schools, demonstrating via the FAFSA that you can afford the full cost may benefit you in the admissions process.

A completed FAFSA can give you leverage with your student. In our household this is called the “no tattoos” rule. Whatever your requirements to contribute to college– pursuing a pre-professional major, achieving a minimum GPA, not getting tattoos– chances are you don’t really want your student dropping out of college if they don’t meet your requirements. But if you haven’t filled out the FAFSA, your student’s primary recourse, besides dropping out, is the private loan market.

So, parents of high school seniors or current college students, do the FAFSA if you haven’t already. It’s free, it’s here, and it might just pay for itself.

What about the CSS Profile

While all schools use the FAFSA to allocate federal funds such as Direct Student Loans, a subset of schools– primarily private schools– use the CSS Profile in their financial aid calculations. There are a few key differences between the two forms:

The Profile considers a broader range of assets than does the FAFSA. For many families, the most important ones are home equity (although a number of schools have dropped or limited its importance) and non-parent-owned 529 accounts. Other Profile assets include cash value insurance policies and small businesses. Home equity is based on the Federal Housing Multiplier Index, not Zillow or your own estimates.

The Profile includes a mandatory student contribution from income, essentially assuming the student has a part-time or summer job. This typically ranges from $3,000-$6,000.

For students whose parents are divorced, the Profile requires both parents to complete it. (The FAFSA only requires the custodial parent to complete it.)

The Profile assesses income and assets slightly differently from the FAFSA. Parents are given a wider range of allowances against assets, such as for emergency savings and private school tuition, and assets are assessed slightly lower– 5% vs 5.64%.

Colleges can include additional questions of their own. These might include questions about the family’s cars, how students got summer jobs, whether parents receive any financial gifts, and more.

The CSS Profile’s calculation is referred to as Institutional Methodology. This is somewhat misleading insofar as institutions have a great deal of latitude in interpreting the data. For example, some cap home equity at a multiple of parent income. Others factor in regional differences in cost of living. The primary requirement is that the institution’s methodology is applied consistently across all students.

A small group of schools uses the Profile and FAFSA in what’s called Consensus Methodology. These schools wanted to standardize financial aid calculations between themselves. Key features of CM are that home equity is capped at 1.2x parent income and student assets are assessed the same as parent assets.

One really important difference between the FAFSA and the Profile is that the first F in FAFSA stands for Free. Profile starts with a different letter; you will pay $25 for the first Profile submitted and $16 for each additional school.

Like the FAFSA, the Profile has an EFC estimator. However, given the differences in questions and calculations from school to school, you are better off using individual schools’ net price calculators to get more accurate estimates of your costs.

And remember, although the Profile is commonly considered the FAFSA for private colleges, it’s actually only for a subset of about 200 private colleges. So before putting too much energy into figuring out the Profile, you should start by figuring out if you even need to file it.

Next section: The FAFSA Formula Explained

Learn what you need to know about the FAFSA formula and what goes into it’s output—the expected family contribution (EFC)

My YouTube video about why you should file the FAFSA - subscribe to my channel to get updates on new videos—https://bit.ly/3CLhmYF