The College Financial Plan Masterclass

Develop a custom plan to get your child a great education at a price that you can afford. Find great colleges. Get great scholarships. Minimize student loans and maximize free money.

What if you could save thousands of dollars and millions of headaches from trying to figure out how to pay for your kids’ college?

Imagine …

Your child getting a great education without risking their financial future or your retirement

Helping your child make an informed financial decision about which college to apply to

Being confident about how you’re going to pay for college

Understanding the FAFSA, financial aid, and merit scholarships and how the college system works

Saving thousands of dollars while getting a great education.

Confused about:

What college costs?

How to qualify for financial aid?

How to get scholarships?

How to find colleges that fit academically, financially, and socially?

Built for parents of college-bound high school students

This self-paced course includes all the information, tools, and resources for YOU to build your own custom college plan from choosing where to apply to filling out the FAFSA to negotiating a financial aid package.

For just $299 you can save thousands of dollars and millions of headaches.

Ann Garcia, CFP® is The College Financial Lady

Like you, I’m a parent. I’m also a Certified Financial Planner™ and the author of How to Pay for College.

I have helped thousands of families— including my own— save millions of dollars on college. My kids are now attending their top-choice colleges at a cost we can afford.

You’re right to want great educational opportunities for your children. And if you know where and how to look, you’ll find them.

This course will help you:

Understand how the system works

Get more scholarships and financial aid

Find great college fits: academic, social and financial

Build a financial plan that minimizes loans and maximizes free money

And so much more …

What People Are Saying

“As a parent with three in college at once, and a high school administrator overseeing the college counseling systems, I feel very knowledgeable about the application and financial aid process. But I knew there were some gaps in my knowledge that could cost me money and my kids opportunities. I learned so much from the course; I was able to strategize and save even more!”

— Vicky Virnich, Colorado

“Ann was great in helping us navigate the maze of hard rules and rules of thumb. The explanations and materials were clear and easy to follow. Can’t thank her enough for helping my family pull together a college plan for our kids.”

— Tom Fry, Colorado

Here’s What You’ll Learn

-

Setting Expectations

We’ll start at the beginning: why college matters and why it’s a good investment in your child’s future. You’ll have some homework to capture what’s important to you and to your student when you think about their college experience.

-

Your College Budget

We’ll create a detailed college budget and give you some tools to guide a more productive and positive conversation with your student about college costs. This will give you and your student a framework for the college search and application process.

-

FAFSA, CSS Profile & Financial Aid

The FAFSA is the first step in getting college scholarships. Do it right and you could save tens of thousands of dollars. We’ll identify and implement strategies to reduce your Expected Family Contribution. Bonus content for divorced parents, business owners and more.

-

How to Get Scholarships

There’s a scholarship for every student if you know where to look. We’ll walk through how merit scholarships are awarded, where your student is likely to get scholarships, and how to find outside scholarships. Bonus content for student athletes.

-

Application Strategies

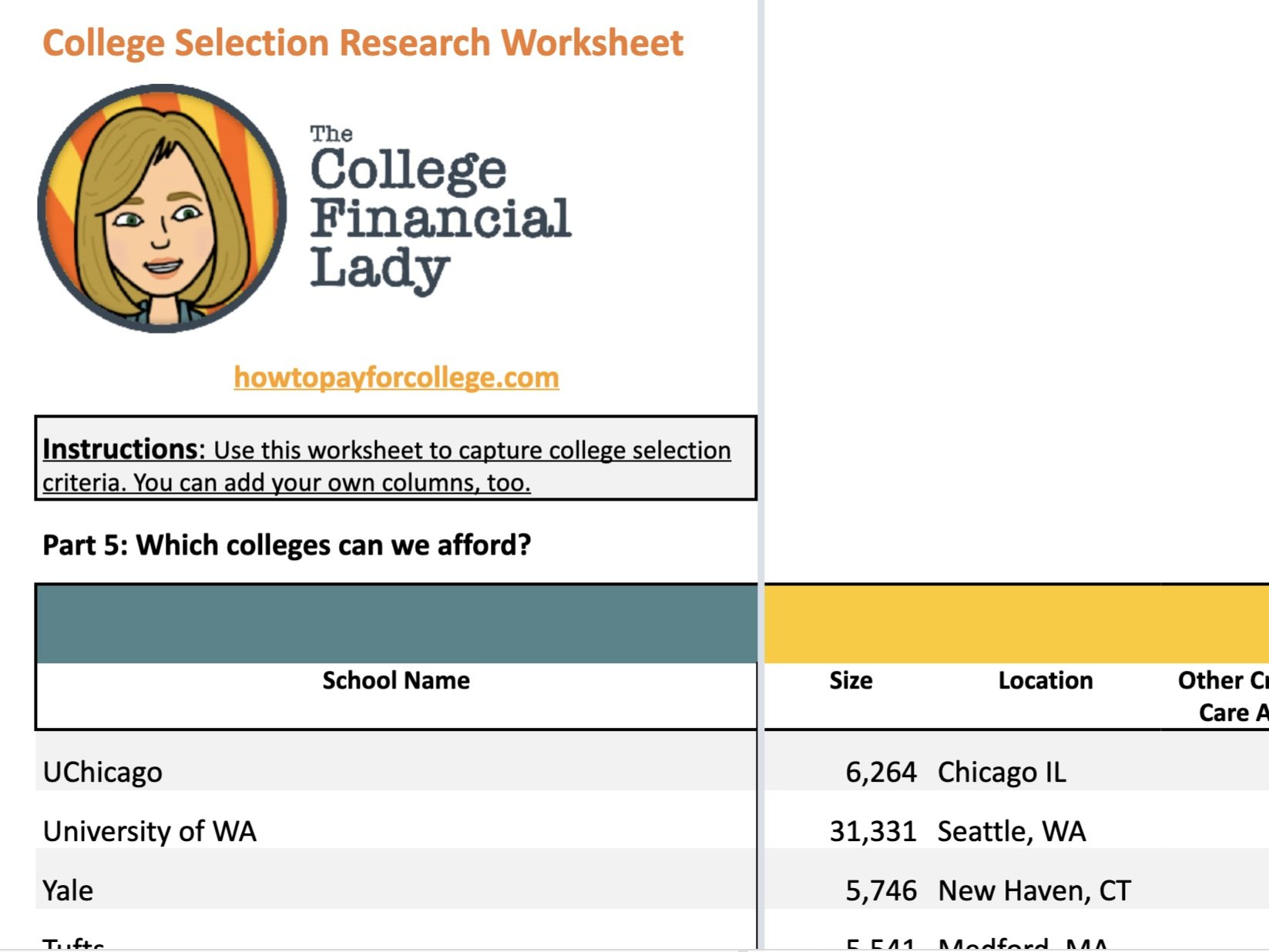

Choosing the colleges you’ll apply to should be fun, not stressful, for you and your student. The course includes my College Selection Research Worksheet as well as tips for how to find colleges that are likely to give you scholarships, plus insights into finding the best fit for your student academically and socially.

-

Spending Plan

You’ll develop a spending plan that gets you through four years with a maximum of free money and a minimum of debt. Learn about 529s, tax credits, student loans and Parent PLUS loans. The College Financial Plan Workbook provides detailed calculations and comparisons.

-

Financial Aid Awards

Congratulations! Now that your student has been accepted to some colleges and received financial aid awards, you’ll learn how to read an award letter, make apples-to-apples comparisons, calculate your bottom-line cost, and negotiate for more money.

-

Resources

To make things easy, all of the tools contained in the course plus additional content and links are consolidated here. In addition to the course materials, you’ll get the FAFSA’s EFC Formula Guide, podcasts, helpful links and much much more!

What People Are Saying

“We came to know Ann via Ron Lieber's book, The Price You Pay for College. The book's insight to the overwhelming mind-blowing task of financing your child's/young adult's college education was and is illuminating. Mr. Lieber's introduction of the financial planner Ann Garcia was to become for us the light being turned on in a dimly lit room full of 'where do we begin and self doubts,' we immediately found Ann's site and reached out to her. Ann's expertise guided us and schooled us in money saving and timely decision making. Without thinking about it we will return to Ann this coming summer to work through year two's financial challenges because simply put: a peaceful mind is one that rests in sleep at night and that's a beautiful thing.”