FAFSA Basics: An Example

Having gone through the FAFSA formula, let’s take a look at how it works with a few scenarios that illustrate how small changes can have big impacts on EFC, or alternatively, how big changes can have small impacts. Our hypothetical family is a family of four with two children, one a high school senior and the other a high school junior. Both parents are 48. Their 2018 household income was $106,800 and they filed married filing joint in 2018. They live in Oregon. To simplify life, let’s assume that all $106,800 is earned income. Neither student has income above the student income protection allowance ($6,840), nor does either have any assets.

For our first scenario, let’s assume that each parent earned half of that income ($53,400), and that both contributed the maximum amount to an IRA in 2018, a total of $11,000. Other than that, they took the standard deduction ($24,000) and tax credits for each child ($2,000 for the younger, $500 for the older). Let’s also assume that their total non-retirement assets are less than their asset protection allowance of $6,000.

Starting with income, their adjusted gross income was $95,800. Each parent’s income earned from work was $53,400. Their taxable income for the FAFSA is $95,800, and they had $11,000 in untaxed income (the IRA contributions). Thus their total income is as above, $106,800.

We start by subtracting their taxes:

Federal taxes owed of $5,728

FICA allowance of $8,170

State allowance of $6,408

Total tax allowance = $20,306

Next, they get an income protection allowance. Since the FAFSA is for the 2020-2021 school year when their oldest will be in college, they use the income protection allowance for a family of four with one college student, which is $29,340.

Both parents work, so they’re also eligible for the Employment expense allowance of $4,000.

Total allowances against income are $53,646, making their Available Income $53,154.

If they had assets above the Asset Protection Allowance, those would be added to the Available Income to calculate Adjusted Available Income.

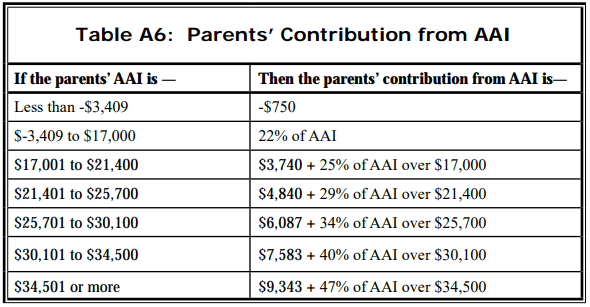

Next, brackets—like tax brackets—are applied to this income, as follows:

With Adjusted Available Income of $53,154, this family’s Parent Contribution is $9,343 + 47% of ($53,154-$34,000) = $18,280.

Roth IRA

Let’s switch things around a little bit. Suppose the parents made Roth IRA contributions instead of pre-tax IRA contributions. In that case, the only change is their federal taxes: They would have owed an additional $1,705 in federal taxes, meaning their total tax allowance would increase to $22,011. All other things being equal, their AI (and AAI) would now be $51,449 and their EFC would decrease to $17,544. The Roth IRA contribution decreased their EFC by $736.

529

What if the parents knew they would need money for college, so in 2018 they decided to contribute to 529s for each child instead of IRAs? Now that $11,000 counts as an asset. Assuming they had $6,000 in checking and savings for a total of $17,000 in assets, they need to calculate their contribution from assets. Since their checking and savings accounts use up the entire Asset Protection Allowance, the family has $11,000 in assets. Multiplied by the 12% Asset conversion rate, this results in a $1,320 Contribution from assets.

Now the $1,320 gets added to the AI of $51,449 for an AAI of $52,769. Applying the same formula, their EFC is now $18,164. This is an increase of $620 from additional assets of $11,000.

Two in College

Fast forward a year and now two students will be in college. Let’s assume no retirement contributions because money is going to pay for college. A couple of adjustments get made:

Taxes increase because now both children are over age 17 so the family only gets $500 per child as a tax credit. This increases federal taxes by $1,500.

The Income protection allowance decreases by $3,260 with the second college student.

That brings allowances against income down by $1,760, increasing AI to $53,209. Applying the brackets formula, their EFC is now $18,882. But here’s the good part: EFC is Expected Family Contribution. With two students in college, that gets divided by two so that each student’s portion of the EFC is $9,441.

What’s the takeaway here? First, the biggest impact on your EFC will come from having multiple students in college at the same time. If your students are talking about gap years, you should consider how the timing will affect the cost of college. Next, depending on your tax bracket and overall tax situation, retirement contributions can have a sizeable impact on your EFC because federal taxes are subtracted from income. Finally, assets don’t have a tremendous impact on EFC, and strategies to take them off the FAFSA may have a negative impact on your family’s ability to pay for college.

See FAFSA and CSS for additional details.