The FAFSA Formula Explained

Learn everything you need to know about the FAFSA and how schools use it to evaluate a students’ financial strength on a consistent set of metrics based on the parents’ and student’s income and assets.

What is the FAFSA®?

The FAFSA is the Free Application for Federal Student Aid. It is a tool that schools use to evaluate students’ financial strength on a consistent set of metrics by calculating a Student Aid Index (SAI). It’s also the application for federal student aid programs including student loans. It is based on the parents’ and student’s income and assets. Filing the FAFSA is an annual event for families of college students, starting in fall of senior year of high school.

The FAFSA becomes available Oct. 1 of every year except 2023 when it will be available on Dec. 31; the due date is set by each school individually. And you need to look at the due date for every school you’re applying to. For example, here in Oregon, Oregon State’s FAFSA due date is Feb. 28 whereas the University of Oregon’s due date is March 1.

Truthfully, most people are horrified when they see their SAI because it’s almost always far more than you think you can afford. Which is an important point: your “need” for purposes of receiving financial aid is the difference between a college’s Cost of Attendance and what the FAFSA or CSS Profile calculates your demonstrated need to be. That need can be met—or not met—using three types of aid: grants, loans, and work-study.

The FAFSA does not automatically bring financial gifts and/or guarantee that your needs will be met.

In the same way that straight A’s don’t guarantee admission to Harvard, getting a low SAI does not guarantee scholarships from your school of choice. And similarly, just as straight A’s increase the likelihood that you will get into Harvard, implementing strategies that reduce your SAI increase the likelihood and likely size of financial aid awards. But ultimately, those aid awards will be based on each school’s financial aid policies and will vary tremendously from school to school.

The FAFSA gives you access to federal student aid programs. These include need-based programs like Pell Grants, work study, and subsidized Direct Student Loans; and open-to-everyone programs like Direct Student Loans, Parent PLUS loans, and Grad PLUS loans. No FAFSA means no federal Direct Student Loans, no work study, no Pell Grant. In addition, many state aid programs and some institutional scholarships require the FAFSA for consideration.

Four Components of the FAFSA®

Let’s look at the formula. There are 4 buckets in the FAFSA’s SAI calculation and each is assessed or considered available to pay for college at a different rate. Anything you can spend for college is going to find its way into one of these buckets. If it isn’t an asset, it will become income when you spend it. For example, you don’t count a Roth IRA in your assets since it’s a retirement account, but if you take a distribution from your Roth IRA to pay for college, you add that to your income in the year when you take it. So let’s look at each of those buckets.

Expected Family Contributions 4 Buckets

Parent Income on the FAFSA

Parent income is the biggest item on the FAFSA for at least 99% of families. What people don’t pay attention to is, it’s more than AGI. Fortunately, post-FAFSA Simplification a lot less gets added back. You start with your AGI, then add back any untaxed income on your tax return, whether that’s an IRA contribution or tax-free interest or a Roth IRA distribution. You get an income protection allowance based on your family your size, and you subtract your federal tax liability– federal income and payroll taxes. It’s the most heavily-assessed at 47% for most families. That means that another $1,000 of income will raise your SAIby $470.

Income is prior-prior year, which generally means the most recently filed tax return when you complete the FAFSA. If that sounds like just prior year, remember that in 2023, you’re completing the 2024-25 FAFSA using 2022’s income.

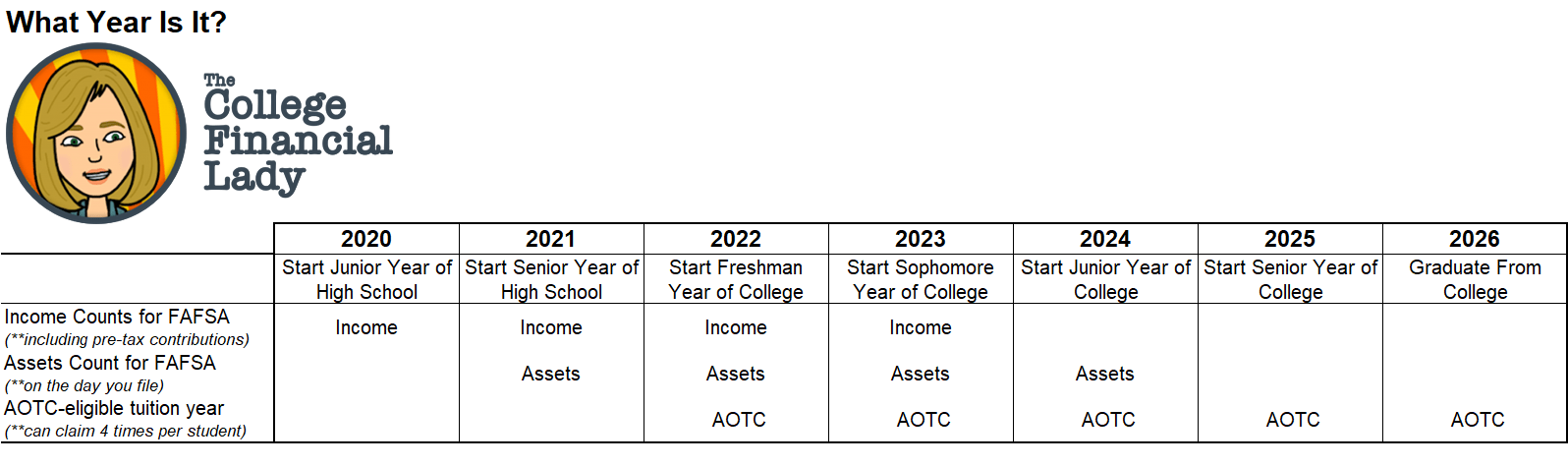

FAFSA input timeline

This just shows the timeline of what gets reported when. As you can see, your first income year for the FAFSA, assuming your student goes straight from high school to college, is the calendar year that starts January 1 of sophomore year and ends December 31 of junior year. Assets, on the other hand, are counted the day you file the FAFSA.

The 2022 tax year, which for a senior graduating in the spring of 2024 started January 1st of their sophomore year, is used for this year’s FAFSA. Assets are valued on the day the FAFSA is filed.

To summarize based on where you are in high school:

Sophomores, this year is your first FAFSA income year. This year is your base year for SAI purposes. All future years will be compared to 2024.

Juniors (and seniors), 2024 income will also count for you for FAFSA purposes, but not until your second year of college. Families of juniors should think about what retirement contributions they can make this year and what to do with student summer job earnings to remove assets from the calculation come fall.

Assets are as of the filing date, which may be as early as October or into the following year depending on the school’s filing date.

Remember that the AOTC can only be claimed for four tax years, so families should decide whether the fall of freshman year is better than spring of senior year for claiming. With the income limit of $160,000 (married filing joint) or $80,000 (single), some families might not be eligible every year.

Breakdown of the 4 SAI buckets

Parent income is the biggest item on the FAFSA for at least 99% of families. Income is prior-prior year, which generally means the most recently filed tax return when you complete the FAFSA. If that sounds like just prior year, remember that in fall 2023, you’re completing the 2024-25 FAFSA using 2022’s income.

Parent income treatment on the FAFSA

AGI (2022 for current FAFSA)

+ Untaxed income on tax return

- Income protection allowance

- Taxes paid

= Available income (AI)

Rate between 22% - 47% of AI | $1,000 more income can translate to a $470 increase to your EFC/SAI

Parent assets treatment on the FAFSA

Assets count for much less than income. Only 5.64% of your assets is considered available. Think of it this way: there’s no way you could come up with the amount the FAFSA will calculate for your income. Instead, it’s assuming your income has given you the ability to save. Yes, spend down your assets, make your retirement contributions, pay your big bills etc etc before filing the FAFSA, but don’t be afraid to save for college because you think it’s going to kill you in the aid formulas. In fact, every $1,000 you have in savings only adds $56 to your SAI, which means you come out ahead by $944.

The following count as Parent assets on the FAFSA:

Checking / savings accounts

The student’s 529

Brokerage / taxable accounts

Investment property, 2nd home

Adjusted value of a parent-owned business or farm

5.64% of total gets added to the FAFSA | $1,000 more of assets translates to $56 increase to your SAI

Student income and assets treatment on the FAFSA

One thing families overlook is student assets. Especially since the FAFSA comes out in October, right after a student earned a bunch of money at their summer job. Student assets count at 20% of their value, so an extra $1,000 in your student’s bank account will increase their SAI by $200.

Income (net of taxes)

-$9,400 allowance

50% of total in excess of the allowance gets added to the FAFSA | $1,000 more income results in $500 increase to SAI

Assets: no allowance

20% of total gets added to the FAFSA | $1,000 more income results in $200 increase to SAI

The FAFSA vs CSS Profile

There’s a second financial aid form, the CSS Profile which is used by about 300 private colleges. Think of the Profile as a way to see if parents are stuffing money into mattresses or otherwise engaging in shenanigans designed to hide their net worth. There are a few key differences which can result in drastically different EFCs for Profile schools:

While the FAFSA only uses tax return data to calculate income, the Profile uses W-2 data as well. That means the Profile adds back pre-tax contributions to employer retirement plans such as 401ks, 403bs and 457s, and to HSAs.

If the parents are divorced, only the parent you live reports their income and assets on the FAFSA. But the Profile requires both parents to file.

On the FAFSA, you only report the student’s 529 if the parents own it. The Profile asks about all 529s owned by the parents or for which the student is the beneficiary. So if the grandparents have a 529 for your student, you’ll need to report it on the Profile.

Finally, the Profile counts your home equity in its formula which can be a really big number, especially these days. Some Profile schools have caps for that, like 1.5 or 3 times income. Others disregard it entirely, assuming you are not going to sell your home to pay for college.

Which brings up another point: The Profile has a bunch of supplemental questions that colleges can add, so depending on what schools you apply to, you might get all kinds of questions. My daughter applied to a few profile schools and we got questions about what cars we drove, whether the kids had a car, and even whether we spent money to get them summer jobs.

Summary of key differences:

Divorced parents: Both parents file

529s: All 529s owned by the parents or for which the student is the beneficiary are reported

Home equity counts

Summary of what counts as an asset on the FAFSA

What is and isn’t an asset on the FAFSA? Here’s a quick “is it or isn’t it?” for you:

| YES, it’s an asset on the FAFSA | NO, it's not an asset on the FAFSA, but could be on the CSS Profile |

|---|---|

| The balance in your checking and savings account | Retirement accounts such as 401(k)s, 403(b)s, traditional or Roth IRAs |

| The balance in your taxable investment account-- You can subtract any debt for which this is collateral, such as a pledged asset line or margin loan. | HSA accounts |

| Your student’s 529 account that you own | Term life insurance |

| Small business o farm that you own | Cash value life insurance such as whole life, VUL, etc—NO on the FAFSA but YES on the CSS Profile |

| Vacation home (make sure to subtract the mortgage from its value) | Cash value life insurance such as whole life, VUL, etc—NO on the FAFSA but YES on the CSS Profile |

| Rental/investment property: yes, unless it’s part of your home that’s rented to a family member (Make sure to subtract the mortgage from its value) | Annuities—NO on the FAFSA but YES on the CSS Profile (if it’s not in an IRA) |

| Vested stock options | Primary residence home equity—NO on the FAFSA but YES on the CSS Profile |

| UTMA or UGMA accounts—YES they are an asset, specifically the student’s asset | 529s owned by grandparents—NO on the FAFSA but YES on the CSS Profile (And distributions from it are student income in the year they’re received) |

| Trusts for which you or the student are a beneficiary—they’re an asset of the beneficiary | 529s owned by your ex-spouse——NO on the FAFSA but YES on the CSS Profile (And distributions from it are student income in the year they’re received) |

| Your elderly relative’s bank account for which you’ve been made a joint owner because they thought that was easier than a POA | Small businesses you own: The CSS Profile will ask for more details including the business tax return. |

| Bitcoin or other cryptocurrency: YES it’s an asset! Crypto is now considered a commodity by the SEC and commodities are reportable assets on the FAFSA. | Family farm that you live on and operate |

| Balance on your credit card: You can’t subtract a credit card balance; you should instead pay the bill before filing. |

The FAFSA’s asset protection allowance

Based on what I’ve heard from parents, the Asset Protection Allowance is the part of the FAFSA that seems to get the most attention.

The Asset Protection Allowance is probably the strangest calculation in all of FAFSA Land. Why is it going up for a change? After a decade of slowly rising median household income and low inflation, we may have finally hit the tipping point. Of course, the economic fallout of the pandemic is likely to change that trajectory.

Setting all of that aside, here is some data. The Federal Need Analysis Methodology for the 2021-22 Award Year shows that most married parents will see their Asset Protection Allowance increase by $600 or more; most single parents will be able to shield at least $400 more than last year.

What does that really mean? Since only 5.64% of assets above the Asset Protection Allowance count towards SAI, having $600 less in FAFSA assets would decrease a family’s SAI by a whopping $34. However, even if the numbers are small, you should take reasonable actions to reduce your assets that might count towards your SAI. Here are some suggestions:

Make a Roth IRA contribution with any extra money in your checking account. Retirement assets don’t count, so shifting money there takes it out of the formula. If you discover later that you weren’t eligible for the contribution, or that you need the money for something else, there is a process to withdraw it penalty-free.

Figure out which days of the month you have the least money in your bank account– typically after your mortgage/rent is paid but before the next paycheck hits– so you can be prepared to file the FAFSA in that window.

Plan to pay your credit card bill and any other bills before filing the FAFSA, regardless of its due date.

Parents of returning students should find out their school’s FAFSA due date– generally in the spring– and plan towards that.

And, while parents tend to obsess over their own assets, the more impactful assets are the student’s. That’s because students get an Asset Protection Allowance of $0 and 20% of their assets count in the SAI. A student with a summer job is therefore likely to get hit in the formula– every $500 in their bank account will increase their EFC by $100. Here are some things you can do to shelter your student’s assets:

Any money they earn that is specifically for college can be put into the parents’ 529 account. In some states, the student will even get a tax benefit for that.

Students with earned income can contribute to a Roth IRA. If they are under 18, the parent will open it as a custodial Roth.

Families might choose to have their student pick up some personal or household expenses in the fall to spend down their bank account and then reimburse them post-FAFSA filing.

FAFSA for divorced parents

FAFSA Simplification changed the rules for divorced parents, too. Previously, the parent with whom the child spent more time filed the FAFSA. Going forward, the parent providing the most financial support will file. This can be more gray than it appears on the surface; the fact that one parent pays alimony and child support and the other receives it doesn’t necessarily mean that the payer is providing the most financial support. It’s possible that the receiver owns or rents a larger, more costly home or provides financial support in other forms.

The custodial parent for FAFSA purposes may or may not be the parent who is given primary custody in the divorce decree or who claims the student on their tax return.

And don’t forget, the CSS Profile will request financial information from both parents.

Amicably-divorced parents should discuss the tax-related issues of claiming the student as a dependent as well. For example, only the parent claiming the student on their tax return is eligible for the AOTC. For single or head-of-household filers, the AOTC phases out beginning at MAGI of $80,000.

8 things NOT included on the FAFSA

As daunting and exhaustive as the FAFSA seems, these 8 things are not included. Since these are often items that could be almost punitive in other circumstances, it’s worth exploring them in a little more detail. See my YouTube video if you’re tired of reading.

Here’s the list from the video:

One - Any money that you don’t have on the date you file the FAFSA. That can be money that you use to pay your credit card bill or mortgage. It can be your paycheck, if you file before you get paid. It can be gifts that others give to you, as long as they do so after you file the FAFSA. It can be an inheritance that hasn’t yet been distributed to you. You should file the FAFSA on the date when you have the least money in your bank accounts.

Two - Distributions from parent-owned 529 accounts. This is the secret sauce of 529s vs taxable investment accounts: Gain in the 529 account is not reported as income on either the tax return or the FAFSA.

Three - Money in retirement accounts as of the date of the FAFSA filing. Parents who normally wait until they file their taxes to make IRA contributions can instead make those contributions prior to filing. You can overfund retirement accounts such as by contributing to both a 401k and an IRA as long as you correct the overfunding by removing the excess by the tax filing deadline. If you delay, you will be penalized.

Four - Credit card and student loan debt. Use your liquid assets to pay down debts prior to filing the FAFSA to reduce your assets, since assets are not reported net of consumer debt.

Five - 529 accounts for your other children or that are owned by anyone other than the custodial parent who files the FAFSA. If grandparents have a 529, it doesn’t get reported. If the parents are divorced, the parent who doesn’t file the FAFSA doesn’t report 529s that they own. And remember that the CSS Profile asks for all 529s for which the student is the beneficiary, regardless of owner.

Six - Mandatory retirement contributions. If your employer requires you to contribute a percentage of pay to your retirement, this is not added back to income because it’s not discretionary. Mandatory contributions are reported in Box 14, not Box 12, of the W-2.

Seven - Each child’s own assets and income are not reported on the other child’s FAFSA. It’s possible that in the same family, some students will get need-based aid and others will not. So you can make different decisions about each student’s assets depending on their situation.

And eight - Income received from a work-study job. Work study is considered financial aid and therefore is not counted as income.

Obviously not all of these are applicable to every situation, and in many cases there are good reasons related to other aspects of your financial situation to do the opposite of what’s above. CPAs and fee-only financial advisors are a great resource in looking at how college planning fits in your overall financial picture.

Next section: Student Loans

Detailed insights into federal student loans and additional information about loans.

My YouTube video breaking down income on the FAFSA - subscribe to my channel to get updates on new videos—https://bit.ly/3CLhmYF

My YouTube video breaking down assets on the FAFSA - subscribe to my channel to get updates on new videos—https://bit.ly/3CLhmYF