What College Costs

Why college costs so much and how to avoid the traps that can make college more expensive.

Why college costs so much now

One of the most common questions families ask is, “How can I plan for college if I don’t know where my child is going to go?” After all, planning for a range of outcomes that could vary by $200,000 or more per child is the ultimate moving-goalposts challenge.

Here’s the secret: You don’t have to plan for all of those possibilities. You only need to plan for the ones that work for your family. Because if you’re willing to use the “Why College?” approach instead of the “Which College?” approach, your student can tailor their college search to schools that are likely to be affordable to you.

As you probably already know, the cost of college has soared over recent decades, far outpacing inflation or growth in household incomes. Most public universities did not charge tuition through the 1960s; during that decade, Baby Boomers’ demand for higher education began to outpace supply and public universities began charging nominal tuition. In 1980, the average annual tuition at public four-year colleges was $804; by 1990 it had only gone up to $1,888. By 2020, it was $16,647. To me, one of the most astonishing aspects of the pushback against free college proposals is that it seems to be coming mostly from the generation for whom public colleges were free or virtually free.

Cost increases in the 30 years from 1986 to 2016:

Public university cost of attendance increased by almost 500%

Private college costs increased by a mere 467%

In that same time period, median household income increased by a whopping 13.6%.

In fact, in the 1985-86 school year, average public college costs were just under 14% of median family income; private colleges cost 33% of median family income. In 2015-16, those numbers were 27% and 56%. How is it possible that colleges can charge prices that are unaffordable to families?

What’s driving the increase of college costs

Why do colleges charge so much today relative to what they cost 30-years ago? The simple answer is: Because they can. It’s important to remember that colleges are businesses, and businesses set prices based on supply and demand.

Just looking at the demand side, at selective private colleges typically 25% to 33% of applicants don’t even file a FAFSA or CSS Profile. That means that between 1/4 to 1/3 of students are expecting to pay the full sticker price. Why would a college turn them down? On the other hand, that leaves the college with somewhere between 2/3’s and 3/4’s of its student body remaining to be filled, and by a population that can’t or won’t pay full price. This is where a savvy and informed buyer can benefit.

There are contributing factors to the meteoric rise of college costs and those include:

Declining state funding and increasing state costs

Increased administrative and services costs

Increased availability of financial aid, especially loans

More students going to college

Avoid the traps that make college costs creep up

One important reason college can be more expensive than you planned: students taking longer than four years to graduate. Often this results from transferring, in particular because the new school may or may not give full credit for coursework at the original school. Sometimes students transfer for their own reasons— discovering that the school they loved on paper isn’t as great in person, or choosing a major or career path that their school doesn’t offer, or starting at a community college before transferring and finishing at a four-year college, for example. In other cases, schools close down and students are forced to find a new college. Whatever the case, adding an extra year to your studies increases your cost by at least 25%.

The bottom line - college costs what you’re willing to pay

Your job as a parent is to help your student figure out what’s important for them to succeed in college and to identify schools that provide that at a cost that works for your family. The purpose of this site, my upcoming book How to Pay for College (to be released in 2022), and my College Financial Plan Masterclass is to help you map out a plan for your family to get your kids through college without wrecking your retirement or their future. Your kids are going to have a lot of good choices

Paying for college realities - savings is only part of the equation

Most families use a combination of savings, cash flow, and loans to pay for college. That means you don’t need to save the full cost of college before you start.

As important as college is for many families, it’s only one of your family’s financial priorities. Retirement, emergency savings, buying a house, and even just managing a household budget are among the many draws on your dollars. If you don’t have an emergency savings fund or you aren’t saving for retirement, those need to be priorities before saving for college.

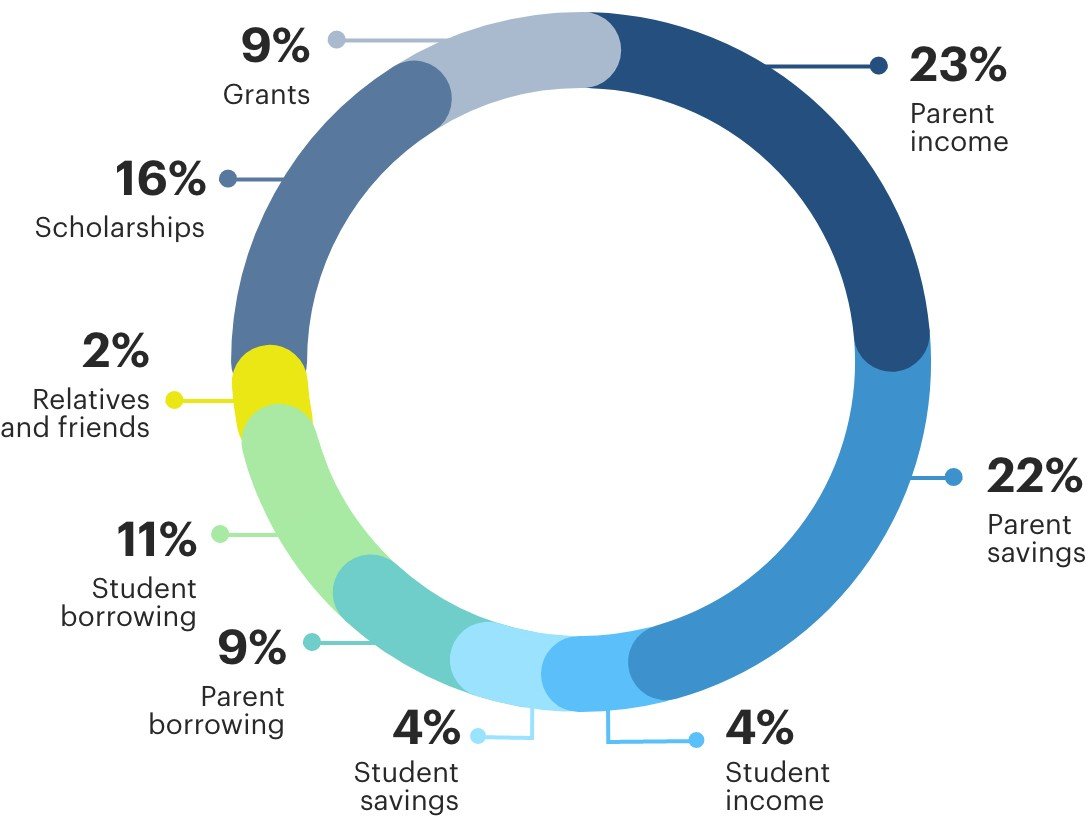

Share of college costs paid by each funding source

This is from Sallie Mae’s annual How America Pays for College survey. Parent income and savings only covers about half the total cost of college on average. Here are some other facts about paying for college:

More than 2/3 of students take out loans, and lots live to regret how much they borrowed

Slightly more than half of parents save for college, and just over 1/3 of families use 529s

More than half of students contribute to their college costs

Next section: Savings Creates Choices

Learn about how much to save and your savings options (529s and more)

Want to get in control of your college planning? Enroll in my College Financial Plan Masterclass and get insights, tools and framework to build out your personalized plan.